Written by Owen Zammit (Senior Analyst) together with Orly Savion, Ph.D. (CTO), Andjela Martinovic (Scientific Analyst), and Giulia Pauly (Analyst Intern)

https://www.pexels.com/photo/assortment-of-fresh-vegetables-and-fruits-put-in-plastic-bags-4033160/

At PeakBridge, we are committed to learning more about FoodTech trends as they emerge. After being exposed to multiple sustainable food packaging startups, we decided to review the space to better understand the current industry and its challenges, the technological approaches, and the startup landscape. This is the seventh installment in the series, following our recent post on dietary fibres.

Introduction

In ancient history, the consumption of food was limited to the proximity of its capture or production, with no need for food packaging. The last 200 years saw the greatest acceleration in packaging innovation from a simple container to a key element in product design. This shift was the result of several key drivers, including war, globalization, and mass production.

Food packaging provides various benefits, including containment and protection from pathogens and moisture, as well as serving as a communication tool for brands. Despite the myriad of benefits, adverse media publicity and political attention have brought food packaging into a negative light.

So, what is wrong with food packaging?

- Impact of production on natural resources

The process requires large-scale consumption of natural resources. Metal packaging depends on bauxite mining which causes water pollution. Most plastics are derived from non-renewable sources like crude oil or natural gas. Paper & cardboard packaging contribute to deforestation leading to soil erosion and an increase in greenhouse gases (GHG). Fortunately, both materials have high recycling rates – paper (68%) and cardboard (91%)1. - Landfill use

The US Environmental Protection Agency (EPA) states that food and food packaging materials account for nearly 50% of all solid waste generated by municipalities2. Over the last few decades, solid waste generation has changed substantially, increasing from 88.1 million tons in 1960 to 292.4 million tons in 2018. The EPA has disclosed that some American states might run out of landfill space at this rate of waste generation. - Land and marine waste pollution

There is currently an estimated 30 Mt of plastic waste in seas and oceans, and a further 109 Mt has accumulated in rivers. The build-up of plastics in rivers implies that leakage into the ocean will continue for decades to come, even if mismanaged plastic waste could be significantly reduced.3 - Health concerns

Microplastics are tiny plastic particles measuring less than 5mm in diameter that form during the degradation of plastic waste in the environment. Their ingestion can lead to potential health issues such as inflammation, tissue damage, and cancer. Studies have shown that microplastics can accumulate in the human body over time, and their long-term health impacts are not yet fully understood.4 - Recycling contamination

Food packaging is one of the major sources of contamination in the recycling stream. Research from Biffa has revealed that nearly one-fifth (17%) of England and Wales’ waste cannot be recycled due to contamination.5

Status Quo

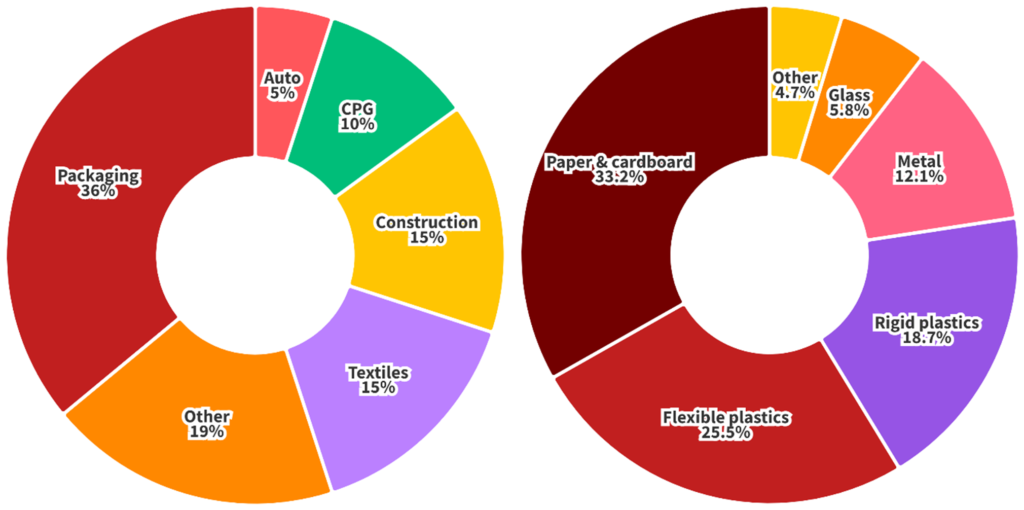

Key Materials

The choice of food packaging material influences food shelf life and quality throughout distribution. Traditionally, the key materials used have been metal, glass, paper, and plastic, with different combinations used to enhance function and aesthetics. Packaging can be broadly grouped into flexible and rigid. Flexible types are readily shaped and changed. They are produced from a combination of plastics, paper, and foil which might be challenging to recycle properly. Flexible packaging does offer a few sustainability benefits over rigid solutions. Its lightweight nature means it provides a higher product-to-package ratio, lower carbon footprint during transportation and occupies less landfill space. Rigid packaging refers to plastics, glass, and aluminium containers whose shape cannot be easily altered. They may offer higher robustness yet are more expensive and heavier than the flexible counterparts.

This review will focus on plastics, given their widespread use and detrimental environmental impact, particularly single-use plastic (SUP). The impact is such that scientists have discovered plastic pollution being deposited into the fossil record, claiming that the current period might become known as the Plastic Age6

Plastics are made from resin, a material which can be formed into different shapes using controlled heat and pressure at low temperatures, unlike metal and glass. Resin is made from natural gas, oil, or other petrochemicals that undergo a chemical process called polymerization, in which small molecules (monomers) are linked together to form long chains (polymers). Although hundreds of subtypes exist, only a handful are used for food packaging. The specific resin used to make a plastic product depends on the desired properties and applications

| Plastics | Properties | Use Cases in Food | Challenges |

|---|---|---|---|

| Low-density Polyethylene (LDPE) | Flexible yet tough Easy to seal Resistant to moisture | Bread and frozen food bags Flexible lids Squeezable food bottles | The most widely used SUP category, together with HDPE |

| High-density Polyethylene (HDPE) | Stiff Permeable to gas Easy to process & form Resistant to chemicals & moisture | Cereal box liners Water, milk, and juice bottles | |

| Polypropylene (PP) | Good resistance to chemicals Effective water vapor barrier High melting point (160ᵒC) | Yogurt containers Margarine tubs Frozen foods (if oriented) | |

| Polyethylene terephthalate (PET) | Good barrier to gases and moisture Glass-like transparency Shatter resistant Good heat resistance, acids but not bases | Water & soft drink bottles | Recycled versions might leak bisphenol A and antimony |

| Polycarbonate (PC) | Clear Heat-resistant and durable Care should be taken when used with detergents as they might release bisphenol A – a potential health hazard | Sterilizable baby bottles Returnable water bottles Ovenable trays for frozen food | Contact with harsh detergent might release bisphenol A, a potentially hazardous chemical |

| Polyvinyl chloride (PVC) | Transparent Medium strength Ductile Excellent resistance to chemicals (acids and bases) Difficult to separate for recycling | Primarily for non-food applications such as pharma Mainly used for packaging films in food applications | Problems with incineration due to high chlorine content |

| Polyvinylidene chloride (PVdC) | Heat sealable Excellent barrier to water vapor, gases, and fatty products | Packaging of poultry, cheese, cured meats, confectionery, tea and coffee | Problems with incineration due to high chlorine content (twice as PVC) |

| Polystyrene (PS) | Clear Brittle Lightweight Relatively low melting point | Egg cartons Cups Lids Food trays | Migration of styrene into food products, affecting organoleptic properties |

| Polyamide (PA) | Similar thermal and mechanical properties to PET | Boil-in bag packaging Frozen packaging | Chemicals can migrate from packaging into food during processing & storage |

The table above provides a summary of the main plastics and their use as the primary material in the food package. Plastics can be combined with each other or materials such as paper through lamination, to produce a variety of packaging. Paperboard can be extrusion coated with PP to be used in frozen/chilled food trays. Films of oriented polyamide are recommended for frozen or vacuum packaging due to their excellent tear and puncture resistance and high gas barriers.

The Plastics Value Chain

The conventional plastics value chain is complex and interdependent. Any changes in one stage can have significant impacts on other stages, such as the use of biodegradable or recycled materials, waste reduction, and energy efficiency.

Traditional plastics go through the following intermediary steps in the value chain:

- Oil and gas companies extract the necessary feedstock to produce fossil-based plastics.

- The latter is processed under high heat and pressure to produce monomers, the plastic building blocks.

- Monomers are further processed to produce polymers. Other additives and chemicals are added at this stage to end up with a polymer that will be suitable for the final product.

- Final products such as bottles and other forms of packaging are purchased by food manufacturers and distributed through various retail channels.

- Once consumed by the end customer, the packaging enters its end-of-life stage, where it is either recycled back into monomers or ends up in a landfill.

Many companies operate in multiple stages, on the value chain such as ExxonMobil, which is involved in both raw material extraction and polymer production, and Coca-Cola, which is involved in both plastic manufacturing and packaging and distribution.

Innovation

The increasing environmental concerns over plastic waste have led to the exploration of alternative solutions. In this section, we outline four innovative approaches to tackle this issue – bioplastics, edible, smart, and reusable packaging. While edible films and coatings exist, we have not included them in this review since their primary aim is to extend shelf life and reduce food waste rather than directly addressing the issue of plastic waste.

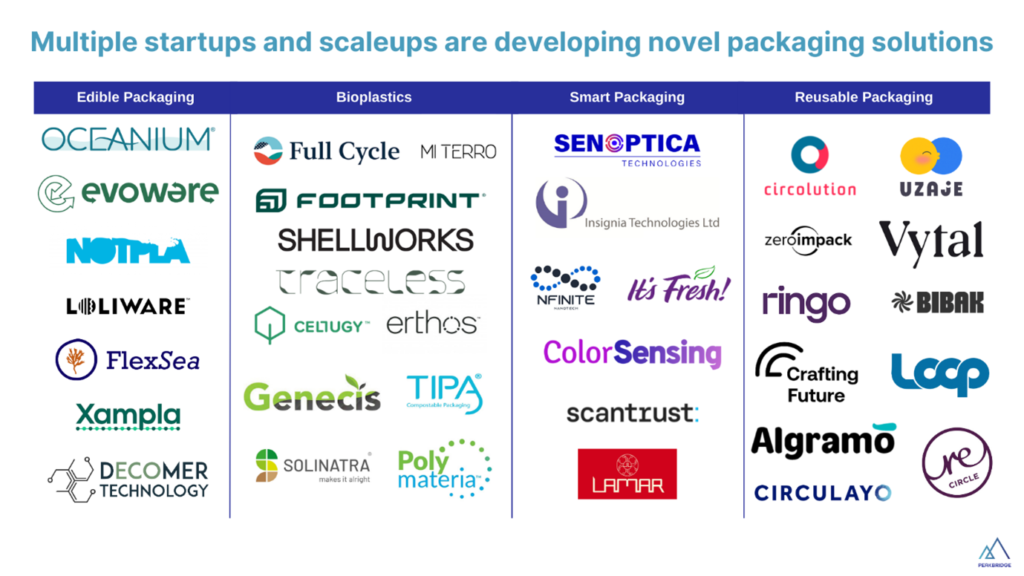

Many startups dot the landscape across the four different approaches. Some focus on edible packaging utilizing seaweed extracts, while others are implementing reusable packaging systems. The graphic below represents a non-exhaustive list.

Bioplastics

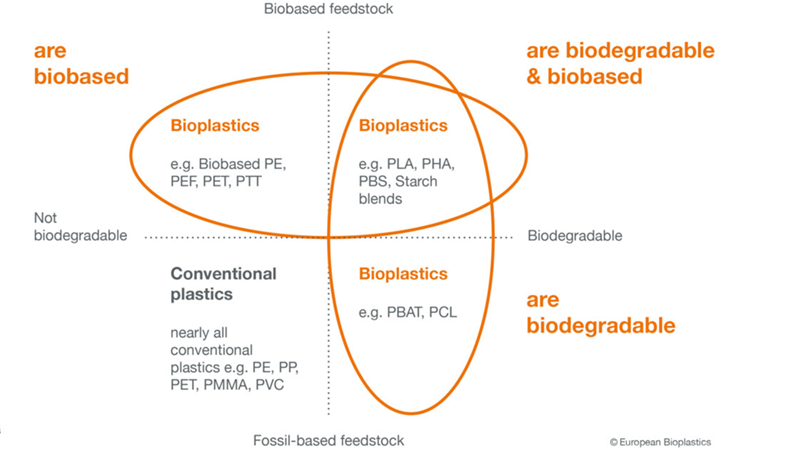

The terminology related to bioplastics can often create confusion. At its simplest, bioplastic is any plastic that is biodegradable and/or derived from natural sources. This means that some petroleum-derived plastics which are biodegradable (such as PBAT) are also considered bioplastics.

In essence, the two key criteria distinguishing the various bioplastics are:

- Feedstock – Petroleum vs. Bio-based

- End of Life – Non-biodegradable, Biodegradable, Compostable

Bioplastics currently make up less than 1% of the global plastics market, as they face challenges in completely replacing some conventional packaging materials that provide better protection and are more cost-effective. However, with enhancing R&D activities and investments by key players like Nestle and Coca-Cola, the bioplastics market is expected to grow in the coming years. In 2021, the global bioplastics market size was estimated at USD 11.2 billion, and it is projected to reach approximately USD 46.1 billion by 2030, with a CAGR of 17.02% between 2022 and 2030.8

Price and performance parity remains the number one challenge. This depends on several factors, including feedstock selection and sourcing. First-generation bioplastics used commodities such as corn which effectively competed for land use with the food system. New iterations using side streams have since been developed. Nevertheless, certain bio-based feedstocks might be used by other processes leading to competition and price volatility. Large CapEx investments are also needed to take bioplastics from lab to industrial-scale production, which further explains price gaps with traditional plastics.

Infrastructure for the proper processing of compostable alternatives is currently lagging the rate of biopolymer innovation. Further investment, together with market education, will be required to avoid unforeseen outcomes when replacing petrochemical-based plastics with bio-based options in food packaging. Barrier properties and easy integration with current plastic conversion machinery are additional key considerations before bringing new biopolymers to the market.

Edible Packaging

This is a separate approach whereby food-grade materials, such as starches, proteins, and sugars, safe for human consumption, are used as the packaging. Edible packaging is designed to be eaten along with the food product, which reduces waste and provides additional nutritional benefits. Examples include edible food wrappers, cups, straws, and films.

Some of the main companies working in this space utilize edible seaweed due to the presence of carrageenan, which is commonly used as a food additive and can be broken down naturally in the environment. Seaweed is naturally rich in fiber and vitamins and can be processed into packaging without the use of chemicals.

Not all seaweed-based packaging, however, is made from carrageenan and therefore may not be suitable for consumption unless it has not obtained the required food regulatory clearance.

Edible packaging can also be derived from milk proteins such as casein, which is flavorless, more effective than plastic at keeping food fresh, and less sensitive to oxygen. Durability can be enhanced through the addition of citrus pectin, which makes it more resistant to high temperatures and moisture. Despite progress, edible solutions still have limited applicability due to inferior barrier properties. Current production requires high energy consumption, meaning economies of scale will be needed to achieve price parity with conventional plastics. The lack of studies on the edibility and toxicology of edible packaging makes it harder to have wide consumer adoption. Additionally, films containing milk proteins might pose challenges to customers suffering from food allergies.

Smart Packaging

Smart packaging is defined as “an active or intelligent technique that involves interactions between package and food (package content) or internal gas atmosphere and fulfills with consumer expectations for high quality, fresh, and safe products.” Active packaging involves packaging systems that actively interact with the product and the packaging headspace. On the other hand, intelligent packaging refers to solutions that continuously monitor and report on product conditions and history. The main respective categories are summarized below.

Active Packaging

| Category | Mode of Action |

|---|---|

| Oxygen Scavenger | Removal of oxygen through enzymes or chemical oxidation of iron powder |

| Moisture Scavenger | Physically absorb and hold water molecules from the surrounding environment |

| Ethylene Absorber | Absorption of ethylene, a growth-stimulating hormone released by certain fruits and vegetables |

| Antioxidant Releaser | Chemicals that prevent oxidative degradation of food |

| Antimicrobial Packaging | Natural antimicrobial chemicals inhibiting microbial growth |

Smart Packaging

| Category | Mode of Action |

|---|---|

| Time-temperature indicators | Shows whether the product is heated above or cooled below a specific threshold |

| Freshness indicators | Monitor microbial growth or chemical changes, typically through colour changes |

| Gas indicators | Monitor changes in the inner packaging atmosphere |

| Barcodes & RFID Tags | Provide information about traceability and food safety |

| Biosensors | Detects and measures biochemical reactions and converts the signal into a measurable output, such as an electrical signal |

| Gas sensors | Detect gases/volatile compounds such as CO2 & O2 |

Cost remains a major barrier to the wide-scale adoption of smart packaging. The implementation of expensive technologies with lower-priced food items is currently unfeasible. Additionally, the lack of unified IoT protocols for smart packaging poses a challenge. However, this situation presents an opportunity for retailers and packagers to collaborate and establish industry standards.

Another challenge lies in effectively recycling the waste generated from smart packaging due to the complex mix of components involved. Data ownership is also a concern, as packagers, retailers, and consumers may have conflicting interests. Privacy issues, particularly regarding GDPR compliance, need to be carefully addressed. However, solutions that avoid collecting end consumer data, such as track and trace systems, could be less restrictive in this regard.

Despite these challenges, there are opportunities to overcome them. Nanotechnology can play a crucial role in enhancing the safety of packaging materials. Advanced packaging materials can be developed to control the release of active agents in combination with embedded sensors in the packaging system. This would address safety concerns effectively. Cybersecurity is another area of opportunity. Existing internet technologies face significant cybersecurity and data privacy issues, which also extend to smart packaging. Robust defense-in-depth strategies and cybersecurity systems are necessary to tackle these challenges. Autonomic detection and response methodologies should be employed, synergizing with prevention techniques. These measures apply not only to smart packaging but also to all cyber-physical systems in general.

Reusable Packaging

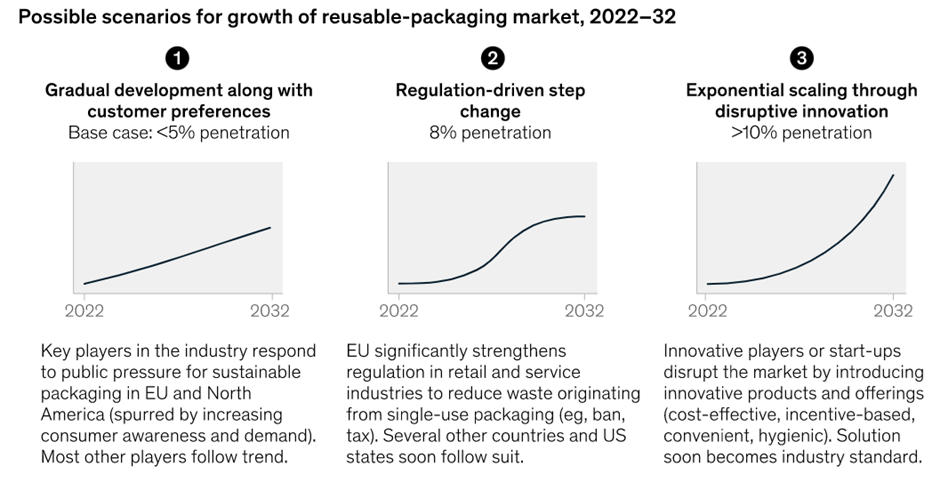

It may seem like a distant future, yet reusable containers were the norm for milk and other beverages in the last century. New regulatory measures are now giving a boost to the once common system. In November 2022, the EU proposed a revision of its legislation on packaging and packaging waste. This included new reduction, recycling, and reuse targets10 The proposal also outlines minimum food packaging reuse and refill targets to achieve by 2030.

According to a report by the Ellen MacArthur Foundation11, there are four main models:

- Refill at home – users refill their reusable container at home (e.g., with refills delivered through a subscription service)

- Return from home – packaging is picked up from home by a pick-up service (e.g., logistics company)

- Refill on the go – users refill their reusable container away from home (e.g., at an in-store dispensing system)

- Return on the go – users return the packaging at a store or drop-off point (e.g., in a deposit return machine)

Regulatory Aspects

Multiple regulations ensuring the safety of food packaging materials have been approved across the US and EU as early as the 1960s. These target multiple elements, including material composition, recyclability, biodegradability, labelling, and traceability. Despite different initiatives supporting bioplastics, there is currently no EU or US law in place specifically targeting biodegradable or compostable plastics13. At a minimum, biobased polymers must abide by the same regulations as traditional plastics. Toxicity testing proving the lack of heavy metals and contaminants must be carried out prior to market entry. As such, the regulatory landscape is still one of the largest question marks. However, this is balanced by supported by the increasing regulatory tailwinds against SUPs.

| EU | US | |

|---|---|---|

| Regulatory Authority | EFSA European Commission | FDA FTC EPA |

| Food-related legislations | Framework Regulation 1935/2004 – general principles for food contact materials and articles, specifies the labelling requirements. Plastics Regulation 10/2011 – safety requirements for plastic materials intended to come into contact with food | Fair Packaging and Labeling Act (FPLA) – consumer (B2C) vs non-consumer (B2B) Uniform Packaging and Labelling Regulation Federal Food, Drug, and Cosmetic Act (FFDCA) – food packaging materials and substances that may migrate into food |

| Sustainability -related legislations | Directive on Packaging and Packaging Waste 94/62 – impact of packaging waste on the environment by setting targets for the packaging recovery and recycling (a new proposed) Directive on single-use plastics 2019/904 (SUP) – various measurements Directive on plastic bags 2015/720 – sets out ways and targets (charges or setting national max. consumption target) to reduce the consumption of plastic carrier bags Policy framework for biobased, biodegradable, and compostable plastics -clarifications on for which applications such plastics are truly environmentally beneficial | National Environmental Policy Act (NEPA) Recycled content regulations – specify the minimum recycled content to be applied Guides for the Use of Environmental Marketing Claims Maine EPR law** – requires producers to finance and manage a statewide packaging recycling program |

| Labeling (B2C) | Compulsory – name and address of the manufacturer or importer, type of material used to make the packaging, safety information, instructions for proper disposal, recycling, or composting (where applicable), symbol of glass and fork for packaging in contact with food Recycling symbols soon will be mandatory, now mainly voluntary. “bioplastics”, “biobased” claims should not be made, only exact and measurable share of biobased plastic content (e.g. “product contains 50% biobased plastic content”) “biodegradable” labelled plastics must specify in which environment they are intended and the required timeframe for their biodegradation | Compulsory – name and address of the manufacturer or importer, resin identification code Voluntary symbols such as keep dry – umbrella, compostable – apple core, “plastic-free” packaging and the product do not contain petroleum-based plastics |

Conclusion

The choice of food packaging material can significantly impact the shelf life and quality of food during distribution. Traditional plastics are widely used due to their versatility and low price. Despite the benefits food packaging provides, a massive production boom has created significant issues impacting the environment and health. The current production trend is unsustainable in the long term and requires novel solutions.

Technological advances in engineering, material science, and nanotechnology are all contributing to innovative approaches, which we have grouped into four categories – bioplastics, edible, reusable, and smart packaging. Regulatory pressure on SUPs and growing consumer awareness are additional tailwinds.

However, the traditional plastics value chain is complex. Introducing novel solutions requires careful consideration of how these can fit into a new model. Unsurprisingly, such innovation faces multiple challenges. These include scaleup (which influences price parity), end-of-life management, and barrier properties. The harmonization of infrastructure and regulation of alternatives will be key to accelerating the successful market penetration of these solutions. This will require input from multiple stakeholders, including investors, policymakers, and innovators, to ensure timely action for the reduction of plastic waste.

Resources

- https://www.afandpa.org/news/2022/unpacking-continuously-high-paper-recycling-rates

- https://www.epa.gov/sites/default/files/2015-08/documents/reducing_wasted_food_pkg_tool.pdf

- https://www.oecd.org/newsroom/plastic-pollution-is-growing-relentlessly-as-waste-management-and-recycling-fall-short.htm

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7068600/

- https://www.circularonline.co.uk/news/nearly-one-fifth-of-recycling-ends-up-unrecyclable-due-to-contamination/

- https://www.science.org/doi/10.1126/sciadv.aax0587

- https://www.european-bioplastics.org/bioplastics/

- https://www.precedenceresearch.com/bioplastics-market

- https://designwanted.com/edible-packaging-four-startups/

- https://environment.ec.europa.eu/publications/proposal-packaging-and-packaging-waste_en

- https://ellenmacarthurfoundation.org/reuse-rethinking-packaging

- https://www.mckinsey.com/industries/paper-forest-products-and-packaging/our-insights/reusable-packaging-key-enablers-for-scaling

- https://www.european-bioplastics.org/faq-items/what-regulatory-framework-is-there-for-bioplastics-on-eu-level-and-what-initiatives-are-underway

Dive Deeper

- Marsh, K., & Bugusu, B. (2007). Food Packaging—Roles, Materials, and Environmental Issues. Journal of Food Science, 72(3), R39–R55. https://doi.org/10.1111/j.1750-3841.2007.00301.x

- Johansen, M. R., Christensen, T. B., Ramos, T. M., & Syberg, K. (2022). A review of the plastic value chain from a circular economy perspective. Journal of Environmental Management, 302, 113975. https://doi.org/10.1016/j.jenvman.2021.113975

- Jeya Jeevahan, J., Chandrasekaran, M., Venkatesan, S. P., Sriram, V., Britto Joseph, G., Mageshwaran, G., & Durairaj, R. B. (2020). Scaling up difficulties and commercial aspects of edible films for food packaging: A review. Trends in Food Science & Technology, 100, 210–222. https://doi.org/10.1016/j.tifs.2020.04.014

- Biji, K. B., Ravishankar, C. N., Mohan, C. O., & Srinivasa Gopal, T. K. (2015). Smart packaging systems for food applications: A review. Journal of Food Science and Technology, 52(10), 6125–6135. https://doi.org/10.1007/s13197-015-1766-7

- Cruz, R. M. S., Krauter, V., Krauter, S., Agriopoulou, S., Weinrich, R., Herbes, C., Scholten, P. B. V., Uysal-Unalan, I., Sogut, E., Kopacic, S., Lahti, J., Rutkaite, R., & Varzakas, T. (2022). Bioplastics for Food Packaging: Environmental Impact, Trends and Regulatory Aspects. Foods, 11(19), Art. 19. https://doi.org/10.3390/foods11193087

- Johansen, M. R., Christensen, T. B., Ramos, T. M., & Syberg, K. (2022). A review of the plastic value chain from a circular economy perspective. Journal of Environmental Management, 302, 113975. https://doi.org/10.1016/j.jenvman.2021.113975

- Dey, A., Dhumal, C. V., Sengupta, P., Kumar, A., Pramanik, N. K., & Alam, T. (2021). Challenges and possible solutions to mitigate the problems of single-use plastics used for packaging food items: A review. Journal of Food Science and Technology, 58(9), 3251–3269. https://doi.org/10.1007/s13197-020-04885-6

- Coles, R., McDowell, D., & Kirwan, M. J. (2003). Food Packaging Technology. CRC Press.

- Labuza, T. P., Breene, W. M.: “Applications of “active packaging” for improvement of shelf‐life and nutritional quality of fresh and extended shelf‐life foods”, Journal of food processing and preservation 13(1), 1-69, 1989. doi: 10.1111/j.1745-4549.1989.tb00090.x.