Written by Eva Everloo (Analyst – PeakBridge) together with Orly Savion, Ph.D. (CTO – PeakBridge), Anđela Martinović, Ph.D. (Scientific Analyst – PeakBridge) & Alice de Rothschild (Analyst Intern – PeakBridge)

As the most abundant product in the global food system that’s present in every plant’s cell wall, dietary fibre is found in all, natural plant-based foods. Commonly associated with whole grains (oats, barley, quinoa, wheat, etc.) and certain processed foods (whole bread & breakfast cereals), it is also abundantly present in vegetables, fruits, nuts and legumes.

With the increased consumption of ultra-processed foods that are typically devoid of fibres, the diet of western and westernized societies has changed radically from that of our ancestors. As dietary fibre plays an essential role in human health, this has implications for public health.

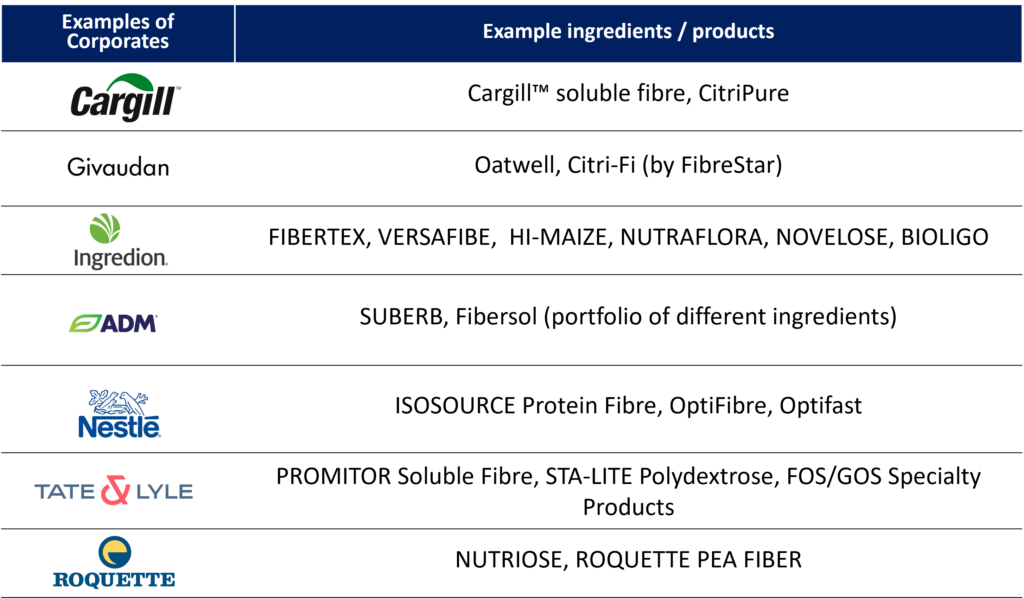

In addition to their well-established health benefits, dietary fibres are also extremely versatile ingredients offering a wide spectrum of functional benefits ranging from emulsification, water-holding, gel formation, thickening, to fat replacement, and more. Due to their low cost, fibres can also be an inexpensive filler ingredient. All these properties are highly desirable in the food industry, which is why dietary fibre is commonly added to dairy products, meat alternatives, and bakery products, among others. Cargill Inc., for example, invested $35M in soluble fibres in 2019 to meet the consumer demand for natural and healthier products[i]. The company has recently added two new fibre products to its portfolio: Cargill™ soluble fibre (a nutritional fibre) and CitriPure® (a functional fibre). Givaudan also recently announced the expanding commercialization of Citri-Fi, an upcycled ingredient from citrus from US-based fibre company Fibrestar to new markets[ii]. Furthermore, Ingredient supplier Ingredion expanded its offerings with new dietary fruit fibres (Fibertex CF 502 and Fibertex CF 102) in 2022[iii]. This macrotrend is also reflected in numbers – in 2022, the global dietary fibre market size reached $8.4B, and it is expected to reach $12.8B by 2028 with a CAGR of 7.4% during 2023-2028[iv].

At PeakBridge, we are committed to exploring and providing novel insight into emerging food trends. We are determined to support innovation that solves ingredient challenges and that sustainably improves human health, addressing two of our investment pillars. Hence, in this post, we will dive deep into the world of dietary fibres, addressing their structure, health effects, key applications in the food industry (traditional & novel, nutritional & functional), together with their challenges and opportunities. Lastly, the innovation landscape is mapped to show some of the companies that are leading the way. This fibre deep dive is the 6th instalment in the series — following our recent post on precision fermentation.

THE BASICS

Definition

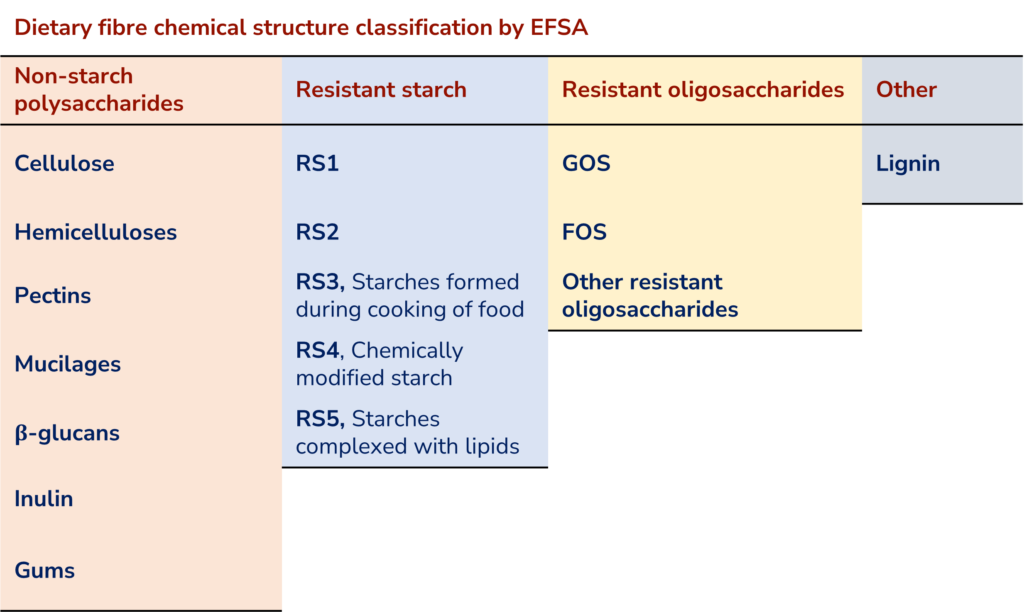

Dietary fibre can be defined as carbohydrate polymers with three or more monomeric units, linked as part of a chain structure, which are neither digested nor absorbed in the human small intestine[v]. It includes four sub-groups:

- Non-starch polysaccharides (carbohydrates)

- Resistant starches

- Resistant oligosaccharides

- Other components obtained from plant cell walls, like lignin.

It was only in 2015 that the definition of dietary fibre was extended to include resistant starches and resistant oligosaccharides. The table below presents the chemical classification of the different subgroups of dietary fibres and their main food sources by EFSA.

Dietary fibres are one of the most heterogeneous groups of compounds found in nature, having diverse microstructures, and physicochemical features that determine their function (in food and in the gut!). Considering the amount of fibre available in our foods, the following variables all have an influence:

- Food source – variability between foods and even within the species/ strain of a single crop.

- Growing conditions – harvest conditions, soil nutrition, sunlight, rain, etc.

- Ripeness – the timing of plant food consumption (unripe bananas can have 8x more fibre vs. overripe ones).

- Processing – e.g., cooking (raw onion has more fibre than cooked onion), refrigeration, canning.

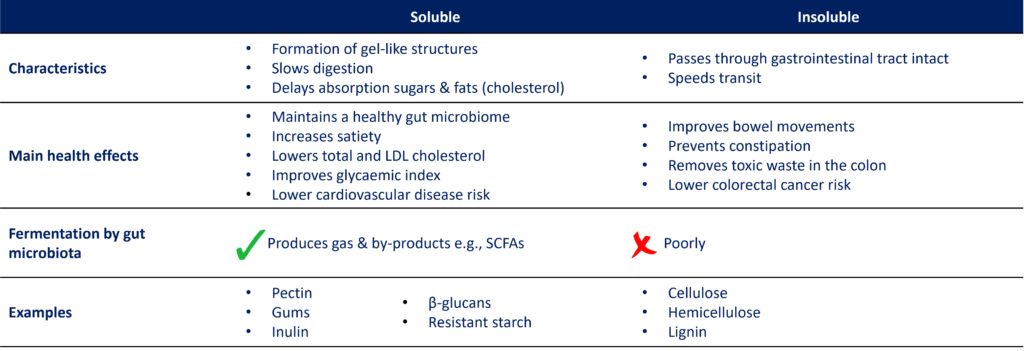

Soluble vs. Insoluble fibres

Traditionally, dietary fibres were classified as soluble and insoluble, defined by their solubility in hot water. Many fibre-rich foods contain a combination of both. The table below describes the main characteristics, health effects, and examples of soluble and insoluble fibres.

Synthetic fibres

Where natural dietary fibres are abundantly present in plant-based foods, synthetic fibres are isolated or created in a laboratory. Synthetic fibres typically have similar functionality and health benefits of natural fibresi. However, when consumed in high amounts, they can cause gastrointestinal issues[vi]. Some of the most common synthetic fibres are methylcellulose, xanthan gum, polydextrose and maltodextrin. Unlike natural fibres, for synthetic fibres to be classified as dietary fibre, their health benefit should be demonstrated in a clinical trial[vii] (e.g., lowering blood sugar, blood pressure, or relieving constipation).

Dietary fibre & human health

Dietary fibres, unlike other carbohydrates such as sugars and starches, are not digested in the small intestine but fermented (entirely or partially) by gut microbiota in the large intestine.

The importance of fibre for human health has been on the radar since 1969, when Denis Burkitt[viii] observed that middle-aged people in England had a much higher incidence of colon cancer, diabetes, atherosclerosis, and asthma compared to similarly aged people living in Uganda. He associated this with the diet of the English, characterised by high consumption of animal products, fat, refined carbohydrates, and ultra-processed foods. Burkitt’s hypothesishas now been confirmed by multiple, large-scale studies[ix][x], that show significant associations between dietary fibre intake and various health conditions as well as mortality.

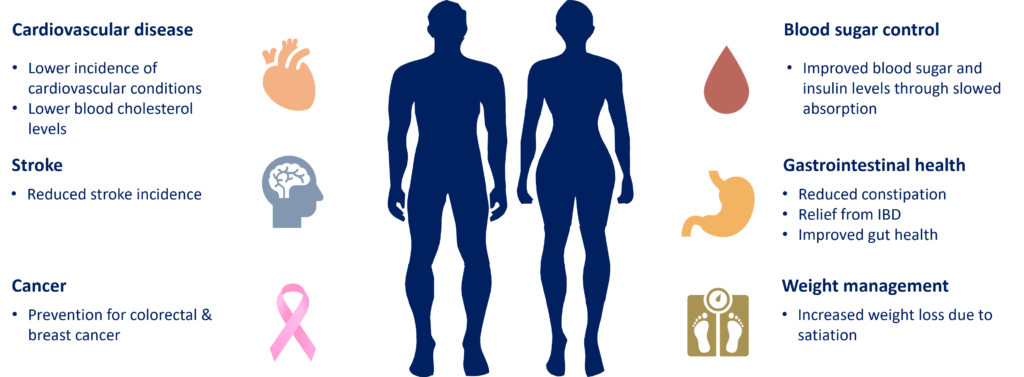

Nowadays, dietary fibre intake in high-income countries (HICs) is around 15g/day[xi]. This is below the recommended daily intake of 30g/day and far from the daily fibre consumption in rural areas (50 g/day)[xii]. If consumed in sufficient amounts, dietary fibre provides numerous health benefits, as summarized in the figure below.

Dietary Fibre & Human Health; SCFAs = Short Chain Fatty Acids (saturated fatty acids produced as intestinal microbials break down fibre); IBD = Inflammatory bowel disease

The gut microbiome functions as an important mediator of the beneficial health effects of dietary fibre, including chronic inflammatory pathways, metabolic processes, and the regulation of appetite. In recent years, our understanding of the health benefits of dietary fibre has been transformed due to the increased data coverage related to our gut microbiome, containing over 100 trillion microbes[xiii]. A higher diversity of gut microbiota is generally linked to healthier physiology. Prebiotics, certain types of fibres (e.g., inulin, GOS, and FOS) that promote the growth of beneficial gut bacteria, play a special role here. While our gut is unable to disassemble these fibres on its own, our gut microbiota can. In this process, these microbes produce various beneficial compounds, including short-chain fatty acids (SCFAs) that, among others, positively affect mental processes, including learning, memory, mood, neural functionality through the gut-brain axis. Scientific findings also suggest a clear role for SCFAs in decreasing (systemic) inflammation[xiv].

KEY APPLICATIONS – THE USE OF FIBRES IN THE FOOD INDUSTRY

Functionality of fibre in food

Not all fibres are created equal, and this is reflected in their food industry applications. A main classification can be made between health and functionality:

- Health: fibres that are used to provide a specific health benefit or to improve the nutritional label of a food product (e.g., FOS, beta glucans).

- Functionality: fibres that are added for their functional properties, such as bulking, gelling, and thickening (e.g., carrageenan, cellulose, polydextrose).

While some fibres can have both functional and health properties, functional fibres are not necessarily associated with health benefits beyond their technical functions.

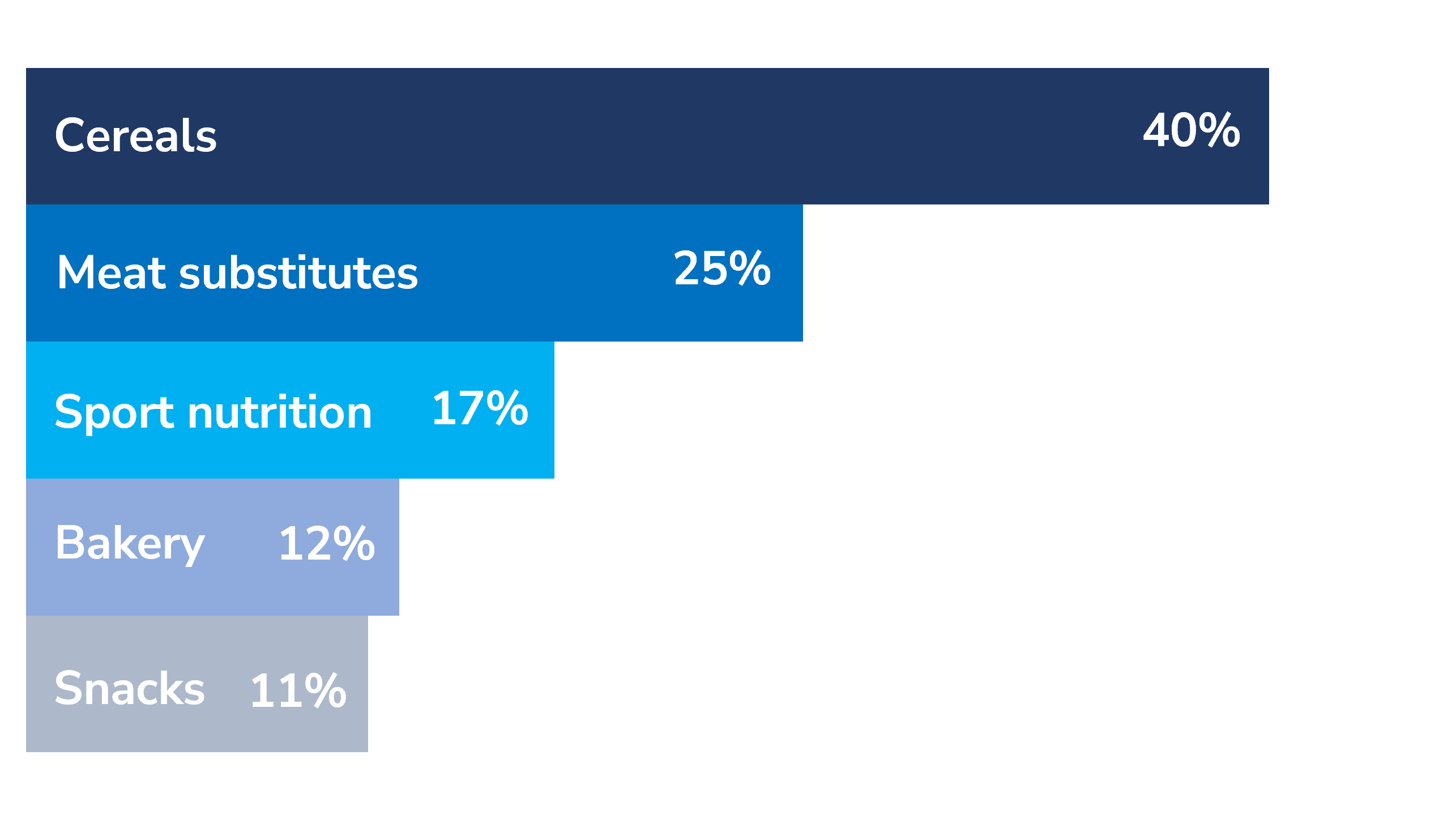

From a health perspective, dietary fibres can elevate the nutritional value of a food product. This benefit can be made visible by a claim on the product’s label. Here, it is interesting to look at which product categories have the most fibre claims, something that consumers increasingly seek out. See the figure below for the top 5 product categories, based on a recent Cargill report[xv].

(% launches in EU in 2022, source: Innova Market Insights)

Market insights from Tastewise furthermore show that high fibre versions of comfort foods have grown significantly in consumer interest over the last year (54% YoY). Also, menu mentions of bakery and dessert items with high fiber explicitly mentioned are up 23% over the past 2 years. Both yoghurt and non-alcoholic beverages have seen a significant boost in consumer discussions, indicating consumer interest for these products combined with high fibre claims is rising. Across all categories, gut health is a primary motivator for consumers to choose high fibre products.

From a functional perspective, dietary fibre stands out as a key ingredient to replace bulk ingredients like sugar due to their neutral taste and ability to improve texture and stability. However, it is especially promising in its ability to substitute fat by binding to water particles and forming a texturizing gel. Indeed, some fibres can mimic the texture and mouthfeel of fats yet provide less energy, averaging just 2kcal per gram (as opposed to 9kcal for fat). Besides acting as a bulking agent and fat replacer, fibres are also used as thickeners to improve the texture and stability of foods (particularly in low-fat and low-kcal products). Lastly, fibres are also a great tool for extending freshness because of their water-regulating capacity.

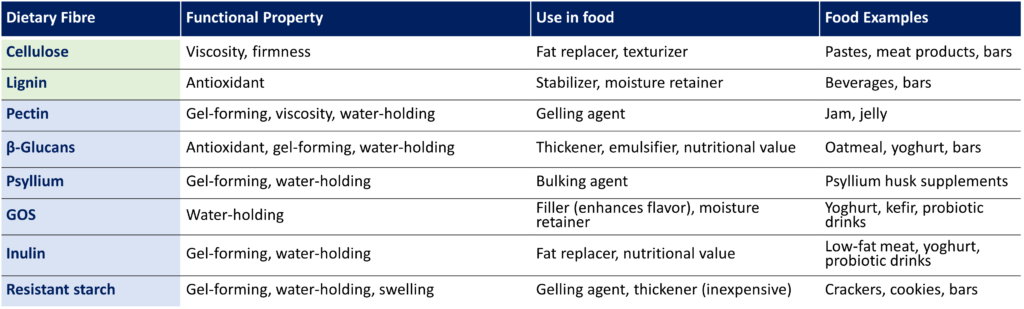

The table below illustrates the functional properties and the use in food of some of the most used dietary fibres that are desirable for the food industry.

Functional properties of commonly used dietary fibres in the food industry (green = insoluble, blue = soluble fibres)

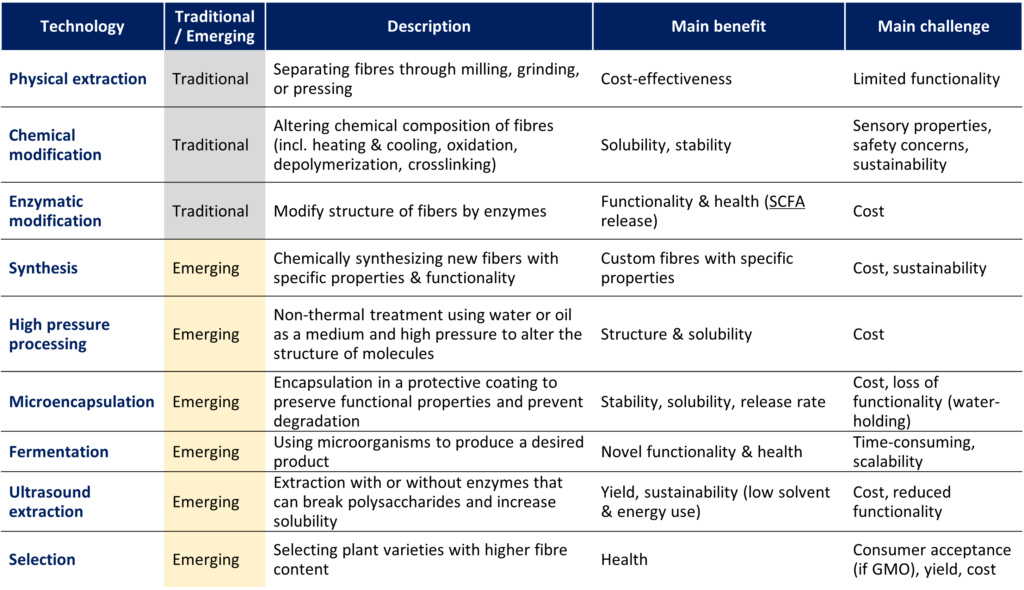

Traditional & Emerging Technologies

Several technologies are used to create or obtain functional dietary fibres, each with its own unique benefits and limitations.

- Traditional technologies have proven to be effective for producing fibres with specific functional properties. They have been widely adopted by food manufacturers.

- Emerging technologies are still in the initial stages of development and commercialization. These offer innovative approaches for creating fibres that are optimized for sustainability, yield, nutrition and/or functionality.

See the table below for the different traditional and emerging technologies. In some cases, a combination of technologies is used. For example, a fibre may be synthesized and then cross-linked to improve its stability, or it may be extracted using physical methods and then microencapsulated to improve its solubility.

The transformation of sugars into prebiotic fibres through fermentation is one additional innovative technology, one that is currently under development by the Kraft Heinz company. The company uses enzymes that convert sugar into fibre when reaching the human gut through microencapsulation[xvii]

WHY NOW?

There are various drivers shaping the expansion of the global dietary fibre market, which can be subdivided into nutritional and functionality drivers.

- Nutritional drivers include scientific advances in the gut microbiome and its modulation by dietary fibres, increased post-COVID-19 awareness of the positive effects of fibre consumption[xviii], and the increasing demand for healthier food products (especially among athletes and health enthusiasts). As chronic diseases (associated with Western HIC diets) pose an increasingly larger threat to public health, more and more consumers are taking an integrated approach to their health, looking for high-fibre functional foods to enhance their health and wellness. Public awareness is exemplified by a recent consumer survey showing consumers increasingly associate dietary fibre with beneficial health outcomes, including gut health[xix].

- Functionality drivers include the increasing demand for low sugar and calorie products[xx], as well as the fast-growing market for alternative protein[xxi] and the associated need for functional food additives (thickeners, emulsifiers, etc.) that are plant-based and clean-label.

CORPORATE & STARTUP LANDSCAPE

In response to this macrotrend, food manufacturers became focused on efforts to improve functional, textural and taste related properties of fibre-rich food products, making them more appealing to consumers. Additional research and development efforts are being directed to the development of new, innovative fibre sources, using novel techniques to meet growing consumer demand for functional foods. See the table below for examples of food corporates working on dietary fibres.

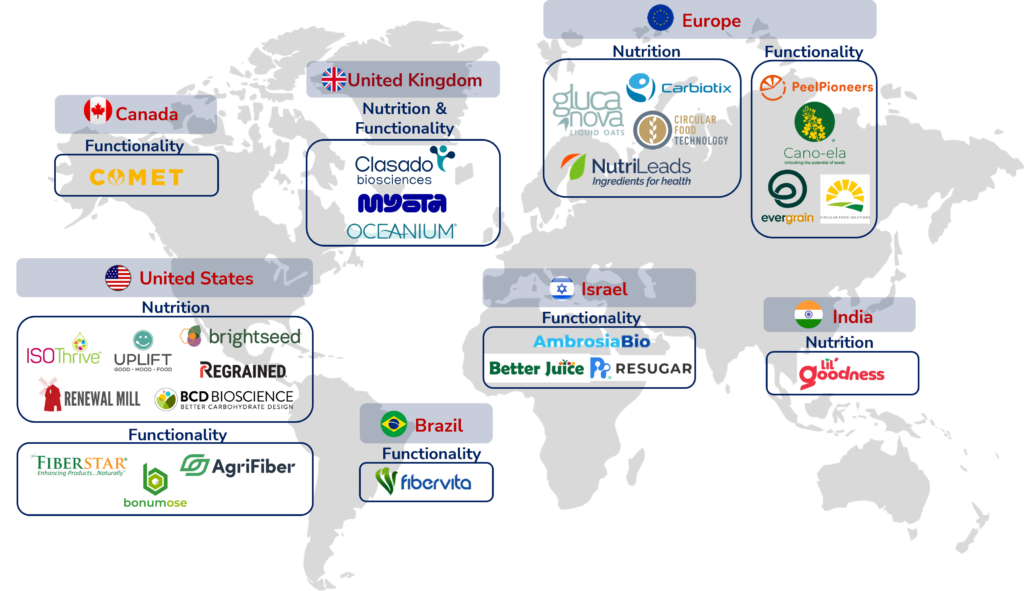

To facilitate these developments, various FoodTech startups are creating innovative extraction technologies, supplements, and functional foods with high fibre content. Some focus on extracting the best fibre out of novel fibre sources (e.g., seaweed, carrot pulp, cassava starch), while others optimize for the best sugar-replacing dietary fibre ingredient. And these are just two examples of applications. See the graph below for a more comprehensive overview of various startups in this emerging space.

REGULATORY ASPECTS

In the EU, a dietary fibre requires evaluation by the EFSA before commercialization in case it is considered a Novel Food (food that has not been consumed to a significant degree by humans in the EU prior to 1997). The Novel Food authorization process involves a scientific assessment by EFSA to determine the safety and nutritional profile of the fibre, and to confirm that it has a physiological effect of benefit to health. Various new dietary fibres have been approved until today, including beta-glucans from oat and barley, psyllium husk, polydextrose and methylcellulose. In the US, the FDA is responsible for regulating dietary fibre and for determining their safety for consumption. Here, the approval process for new dietary fibres depends on whether the fibre is classified as a dietary ingredient or a food additive, where dietary ingredients are subject to less regulatory oversight.

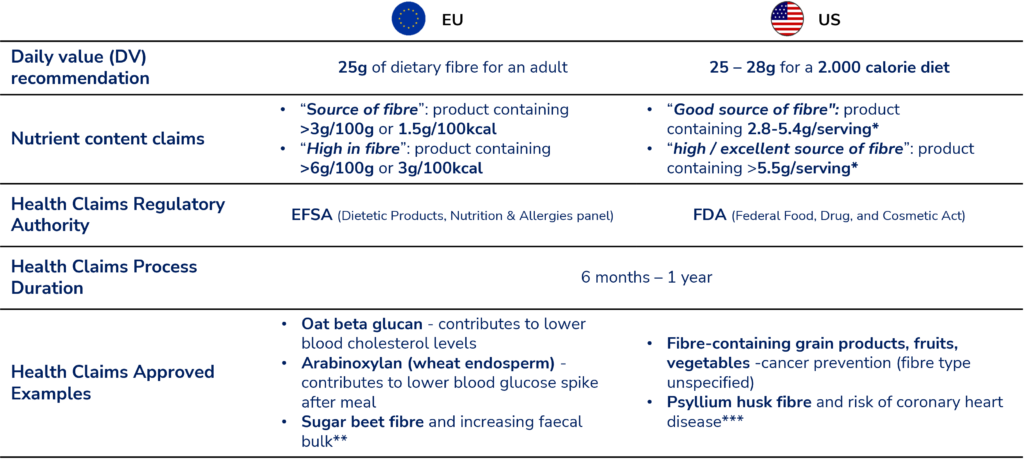

The authorization of health claims for dietary fibres is a separate regulatory process from the safety authorization process described above. It relates to the health benefits of dietary fibre. This process is required for regulating the labelling and marketing of these products and to ensure that consumers receive accurate information and that claims about the health benefits of dietary fibres are supported by scientific evidence. See the table below for further information on health claims and other regulatory differences in the EU and US.

*RACC: reference serving size, customarily consumed; **Conditions and restrictions for use of the claim can be found here[xxii] ; ***Strict guidelines governing the suitability of one of these claims for a given product and the wording that can be used in such a claim, outlined in full on the FDA website[xxiii]:

CHALLENGES FOR DIETARY FIBRE IN FOOD

- Consumer perception

- Limited consumer awareness despite the positive trend, especially compared to other macronutrients linked to health outcomes (sugar and fat).

- Difficult to convince consumers when the health effects are only felt immediately for some fibres (e.g., improved bowel movements).

- Perceived negative health impact for fibres that have an E-number assigned to them (no clean label).

- Low concentrations for use in the food industry

- Due to strong gelling and thickening properties, some fibres (hydrocolloids and gums) can only be used as food additives in low concentrations.

- Adding too much dietary fibre can negatively affect taste, texture, and other properties of foods.

- Limited potential for health claims

- Clinical studies are needed to prove the health effects of a specific fibre, required for obtaining a health claim. It is however difficult to demonstrate a measurable clinical health benefit with statistical significance when testing in a healthy population, who may not experience as significant health benefits as those who are already experiencing health issues.

- Also, study participants are likely consuming other fibres as part of their usual diet. This can make it difficult to isolate the effects of the new dietary fibre on health outcomes.

- This is why not many fibre ingredients have health claims.

- Pre-market authorization requirement

- Novel fibres will require pre-market authorization in Europe as Novel Food and need to be evaluated by the FDA if classified as a food additive. The duration of this approval process can be years.

TAILWINDS FOR DIETARY FIBRE IN FOOD

- Low cost

- Fibre is a relatively inexpensive ingredient compared to other filler ingredients typically used in the food industry, such as polyols (sugar alcohols like erythritol), modified starch, titanium dioxide, and silicon dioxide.

- This makes them, together with their diverse functionality and healthfulness, an attractive option for use in food products.

- Sourcing from food industry side streams

- Circular approach to using already approved sources of dietary fibres (seeds, stems, husks, oil cake, peel, pulp).

- Sourcing for low prices (especially at scale), therefore attractive as a cheap bulking agent.

- Increasing scientific support

- Health benefits associated with high fibre intake are clear and well-established.

- Increased understanding of gut health and the importance of dietary fibre for maintaining it.

- Diverse functionality for use in food

- Many available and novel fibres have unique sets of functional properties.

- Dietary fibres can cater to more and more desirable applications by providing better texture, taste, and nutritional value.

- Dietary fibre answers to the increasing demand for sugar and fat replacers while keeping their functionality in food products.

- Technological developments

- Increased use of emerging processing techniques like microencapsulation, high-pressure processing, and ultrasound extraction.

- Resulting in enhanced functional properties of fibres in food products, including improved yield, functionality, nutritional value, and environmental sustainability, which overcomes restrictions of traditional fibres.

PeakBridge take

At PeakBridge, we see dietary fibre as a promising, low-cost ingredient to potentially replace fat and sugar, enhance the texture of products such as meat alternatives, and improve the nutritional value of any packaged food product. We seek out companies that answer a substantial unmet need both for the consumer and the industry – ones that have a clearly defined target audience and an innovative solution that elevates the functionality of the food matrix of common food products. Hereby, the focus is on B2B ingredient suppliers. A good example of our investment thesis can be presented by our recent investment in Myota, a UK-based company that develops precision fibre blends – tailored to clinical indications such as Type 2 Diabetes and Irritable Bowel Syndrome – based on their proprietary platform that accounts for differences between individuals in their gut microbiome’s ability to ferment different fibres. The company hereby contributes towards the prevention and treatment of chronic diseases. Their science-led approach, leveraging the latest microbiome insights to create hyper personalized nutritional solutions, stood out to us. Furthermore, Myota is looking to obtain EFSA health claims through their ongoing clinical trials, offering a clear path to unlocking B2B opportunities.

BOTTOM LINE

In this deep dive, we focused on dietary fibre, a macronutrient that, over recent years, has not received as much attention as its more well-known counterparts, protein, fat, and carbohydrates (sugars). Due to its wide versatility, the food industry is increasingly exploring the use of fibres in foods, with applications ranging from increasing nutritional value to increasing viscosity and thickness. Various food manufacturers are leading these efforts, complemented by innovation from startups in all applications. With these developments, we are re-embracing fibres to become a significant part of our daily nutritional intake again, making their way back into the most consumed CPG.

Tailwinds for dietary fibre include their low cost, opportunity to source from industry side streams, the growing consumer demand for healthy foods, increased scientific understanding of the modulating role of fibres in gut health, and emerging technologies that further enhance the functional properties and nutritional value of fibres in foods. Some of the obstacles are the lack of consumer awareness for the benefits of dietary fibre (despite growth), perceived negative health effects for fibres that have e-numbers, the lengthy pre-market authorization process for commercializing novel fibres and the complexity around conducting clinical trials needed for health claims.

As more people are digesting the benefits of consuming enough fibre in their diets, and as the food industry continues to deliver better high-fibre products, innovation in dietary fibre has not reached its peak yet.

RESOURCES

[i] https://www.imarcgroup.com/dietary-fibre-market

[ii] https://www.foodingredientsfirst.com/news/givaudan-and-fiberstar-link-up-to-expand-plant-based-texturizing-ingredients-to-new-markets.html

[iii] https://www.foodingredientsfirst.com/news/ingredion-brings-clean-label-dietary-fibers-from-upcycled-citrus-peel-to-emea.html

[iv] https://www.imarcgroup.com/dietary-fibre-market

[v] https://knowledge4policy.ec.europa.eu/health-promotion-knowledge-gateway/dietary-fibre_en

[vi] https://www.researchgate.net/profile/Stuart-Craig-3/publication/8474804_A_review_of_the_clinical_toleration_studies_of_polydextrose_in_food/links/5adf74050f7e9b285945d5cb/A-review-of-the-clinical-toleration-studies-of-polydextrose-in-food.pdf

[vii] https://askaboutfood.com/do-the-new-synthetic-non-digestible-fibers-count-as-dietary-fiber-august-2022/

[viii] https://doi.org/10.1016/S2468-1253(19)30257-2

[ix] https://academic.oup.com/aje/article/181/2/83/2739206?login=false

[x] https://pubmed.ncbi.nlm.nih.gov/31696832/

[xi] https://doi.org/10.1016/S2468-1253(19)30257-2

[xii] https://www.thelancet.com/journals/langas/article/PIIS2468-1253(19)30257-2/fulltext

[xiii] https://pubmed.ncbi.nlm.nih.gov/32840125/

[xiv] https://bevital.no/pdf_files/literature/eslick_2021_jn_nuab059.pdf

[xv] https://www.bakeryandsnacks.com/Article/2022/12/28/New-dietary-fibre-insights-drive-nutritional-and-health-launches

[xvi] https://www.cargill.com/food-beverage/emea/fibers/fiber-innovation-insights-report

[xvii] Sugar-to-Fiber Enzyme for Healthier Food (harvard.edu)

[xviii] https://www.leatherheadfood.com/wp-content/uploads/2019/08/Dietary-Fibre.pdf

[xix] https://www.bakeryandsnacks.com/Article/2022/12/28/New-dietary-fibre-insights-drive-nutritional-and-health-launches

[xx] https://www.cargill.com/food-beverage/emea/fibers/fiber-innovation-insights-report

[xxi] https://www.gminsights.com/industry-analysis/alternative-protein-market#:~:text=Alternative%20Protein%20Market%20size%20exceeded,products%20with%20high%20nutritional%20value.

[xxii] https://ec.europa.eu/food/food-feed-portal/screen/health-claims/eu-register

[xxiii] https://www.ecfr.gov/current/title-21/chapter-I/subchapter-B/part-101#101.81