by Owen Zammit (Senior Analyst – PeakBridge) & Nadim El-Khazen (Partner – PeakBridge)

Climate Challenges

According to estimates, the global population has now exceeded 8 billion and is expected to top 9.7 billion by 20501. It is increasingly clear that our society needs a sustainable way to operate without further contributing to the climate crisis. The United Nations Intergovernmental Panel on Climate Change (UNIPCC) has set 2030 as the climate change deadline for gas emissions to be halved. On the other hand, net zero is expected to be reached by 2050. Such audacious targets require systems change ranging from how we produce energy to how we eat in our daily lives.

COP 27 has added further impetus to the trend, with Europe clearly focused on placing climate tech at the top of its agenda. Climate change, as well as food security, will be top of the agenda as the World Economic Forum’s annual meeting at Davos returns this January.2

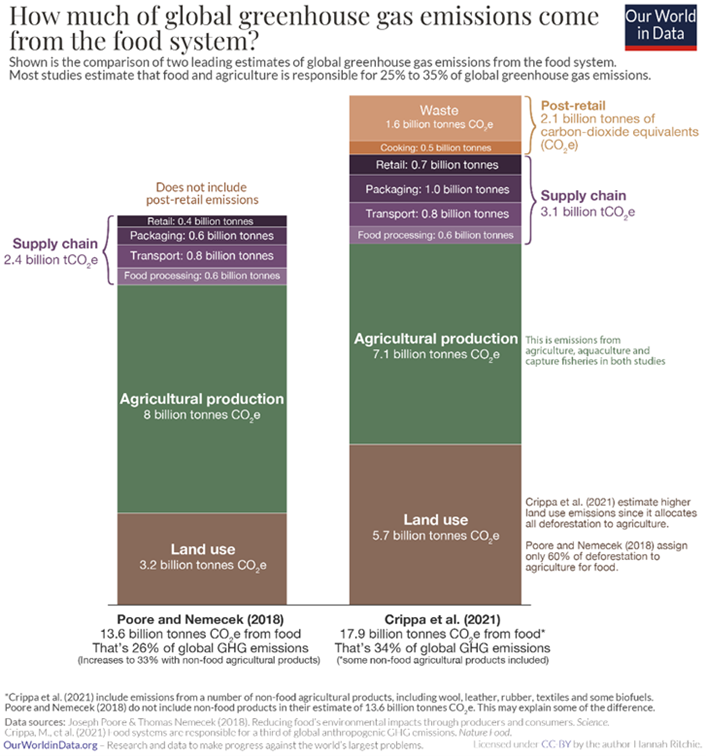

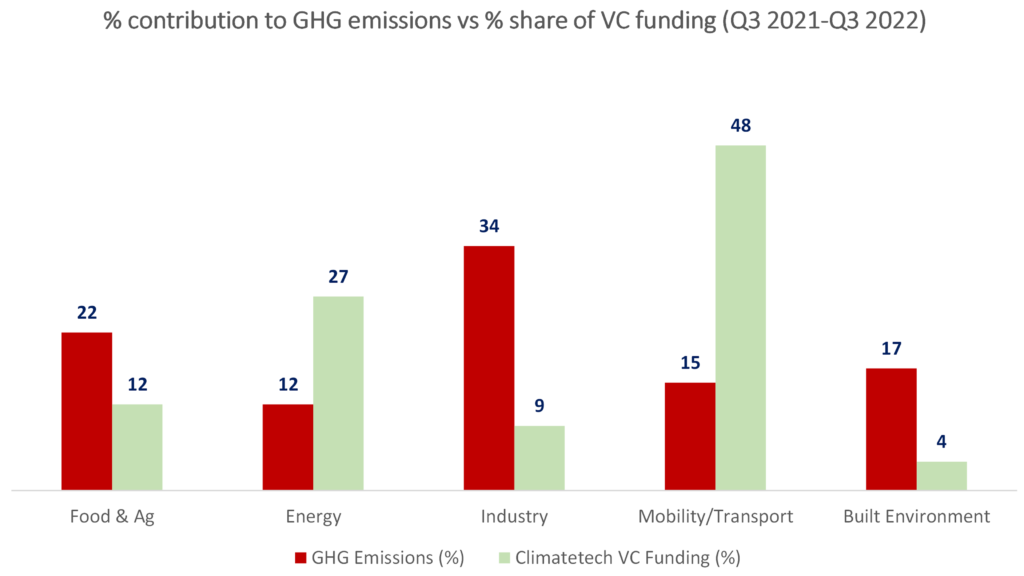

Food production is the third largest contributor to global greenhouse gas (GHG) emissions (see Figure below). Despite food being a key element, according to a recent survey, battery storage and energy were listed as top picks for climate tech investors3. Although studies debate the exact figure for GHG emissions derived from food, what is certain is the fact that one cannot solve the climate change threat without solving it for food.

Increasing arable land to cope with higher nutritional demands often leads to deforestation, loss of biodiversity, and increased water usage. Deforestation reduces the planet’s capacity to capture GHG, leading to the accumulation of CO2 in the atmosphere and to global warming, which in turn weighs on agricultural production. New policies are starting to crack down on these issues, with the EU recently signing a significant agreement to ban the import of goods linked to deforestation. Starting in 2024, the EU will require companies operating in deforestation hotspots to verify that their products have not contributed to forest destruction after December 31, 2020. This will effectively ban the import of food items such as beef, soy, palm oil, coffee, and cocoa while driving the need for new alternatives.4

The deforestation problem is compounded by meat production, which releases significant quantities of nitrous oxide and methane gases with a far higher global warming potential than CO2. Meat

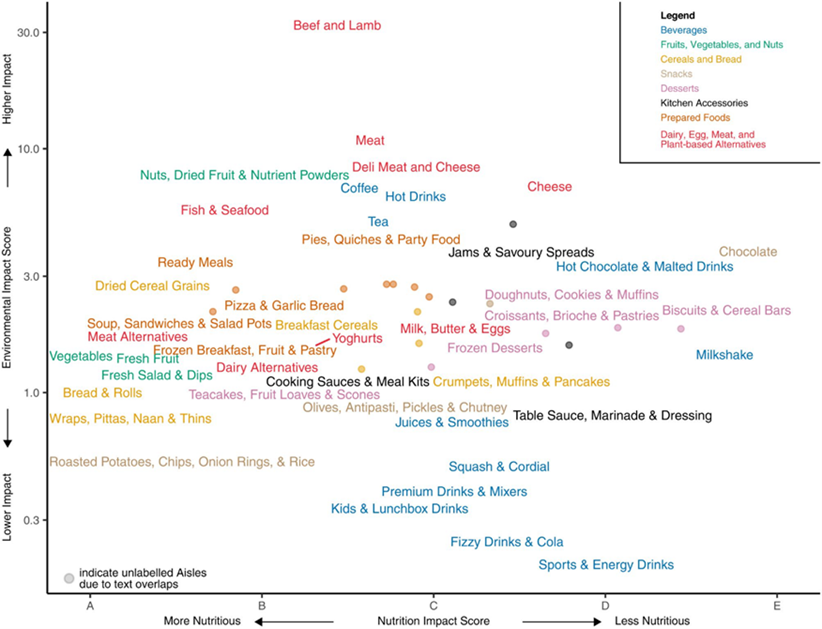

consumption is not going away; in fact, it only continues to grow. As GDP grows, meat consumption reliably grows alongside it5. A recent University of Oxford study6 provided the first estimates on the environmental impact of over >57,000 food products across four indicators: greenhouse gas emissions, land use, water stress, and eutrophication7 potential. It was found that the highest impact aisles with estimated scores of >10 primarily contained beef and lamb products.

Although our food system contributes to climate change, the reverse also holds true. Due to increasing temperatures, rising sea levels, novel pest species, and shock weather events, climate change is influencing how we grow crops, creating a vicious cycle. This leads to farmers dealing with unfamiliar problems, bringing our food security at risk. In a recent piece by Bloomberg8 , it was shown that due to the convergence of global diets, just 3 crops – wheat, rice, and maize – provide 50% of the world’s calories. Innovation is required to better deal with these issues.

Solutions for our food system

Such challenges beg the question – What are the available solutions to help adapt our food system to the current climate crisis?

Alternative Agriculture

Alternative agriculture is a broad term which encompasses all farming methods that are not considered to be part of conventional industrial agriculture. Such methods often seek sustainable performance whilst making sure production is sustainable and does not harm biodiversity. The use of synthetic chemicals as well as genetically modified organisms (GMOs) is reduced as much as possible. Some examples of alternative practices include regenerative agriculture, agroforestry, controlled environment agriculture and organic farming.

One of the most common practices, regenerative agriculture is a farming and grazing method that focuses on rebuilding the soil and restoring ecosystem health. It involves practices such as reduced tillage, cover cropping, crop rotation, and the integration of livestock, which work together to improve soil health, water retention, and biodiversity. The goal of regenerative agriculture is to create a self-sustaining and regenerative system that not only produces food but also improves the environment. It is believed that at least half of the carbon stored in the earth’s soil has been released into the atmosphere over the past centuries9. Utilizing alternative agriculture practices is considered a significant opportunity to improve both human and environmental health, as well as the financial success of farmers.

Alternative Proteins

The reduction in meat production and consumption is driven by an ever-growing push foralternative proteins. Transitioning to plant-based diets has the potential to reduce diet-related land use by 76%, diet-related GHG emissions by 49%, and eutrophication by 49%.10

Broadly speaking, alternatives are protein-rich ingredients derived from plants, insects, tissue cultureas well as fermentation of fungi and microorganisms. One of the most popular approaches is plant-based protein derived from common crops such as soy, peas, chickpeas, and lupin. Fermentation of fungi to develop mycoprotein has been around for decades, with Quorn as a pioneer in the field way back in the 1980s. Fungi have an ideal nutritional profile due to being high in protein and fiber whilst having no cholesterol. Cultured meat is the other major alternative source of protein that has been

developed through tissue-culture technology, which allows for the growth of animal cells in a lab to create muscle tissue with the same protein profile as animal meat.

Waste Circularity

One-third of all food produced is lost or wasted –around 1.3 billion tonnes of food –costing the global economy close to $940 billion each year. If food waste was a country, it would be the third biggest emitter of greenhouse gases after the USA and China11.

Waste circularity refers to reducing food waste and using food by-products and waste to create new products, rather than disposing of them. This can be achieved through various methods such as composting, anaerobic digestion, and using food waste as feed for livestock. For example, composting food waste can create nutrient-rich soil for farming, and food waste can be used to create biogas through anaerobic digestion. Additionally, food industry by-products such as spent grains from breweries or pulp from juice production can be used as feed for livestock or to create new products like flour or cellulose. By applying circular thinking to food systems, it aims to decrease food waste, improve resource use efficiency, and reduce environmental impact.

Novel Ingredients

Novel ingredients can refer to newly created, innovative, or made using new techniques and methods. This can also include food that is traditionally consumed outside of the European Union. Some examples include extracts from existing foods (krill-derived phospholipids), agricultural products from third countries (noni fruit juice) as well as foods obtained from new production processes (UV-treated food). Additionally, upcycled foods use ingredients that would have otherwise not have gone to human consumption to create functional foods with bioactive compounds.

One of the key challenges with introducing novel ingredients to the market is regulation. A Novel Food Regulation in the EU was introduced in January 2018. The regulation covers any food that was not commonly consumed in the European Union prior to May 15th, 1997, when the initial regulations on novel food were established. The aim of such regulation is to ensure products are safe for consumption, labelled properly and is nutritionally similar to foods it is replacing.12 The equivalent regulatory body in the US is the Food and Drug Administration (FDA). Obtaining a ‘Generally Recognized As Safe’ status by an independent panel of experts, can accelerate US market entry when compared to the EU.

The role of FoodTech

The food technology vertical includes start-ups and investors working on developing and scaling products and services which are changing the way we produce, consume, and dispose of our food. Technology can provide scalable solutions. Applied to the context of food system challenges, technology can help us scale alternative proteins, waste circularity, novel ingredients and alternative agriculture.

Alternative Agriculture

Technology can be applied to alternative agriculture in a variety of ways to improve efficiency, productivity, and sustainability, whilst reducing synthetic inputs. Automation, remote sensing and blockchain are all being deployed to make sure this transition is accelerated. For example, robots can be used to perform tasks such as planting, harvesting, and monitoring crop health. Vanilla beans are a highly sought-after crop yet face a few challenges. They are only grown in a handful of countries, are susceptible to weather patterns and suffer from poor quality. Vanilla Vida is a company focusing on growing and curing vanilla beans indoors. This results in products which have a shorter growth cycle and a much higher vanillin content.

Alternative Proteins

The alternative protein universe is wide and diverse, with multiple specific domains requiring specific challenges to be overcome, to ensure final products are both tasty and nutritious as well as economically and environmentally viable. Companies in the space range from working in improving the texture and taste of plant-based cuts, enhancing fermentation capabilities to increase product yields as well as scaling cell-based meat production. Imagindairy, Vow and Rival Foods are all creating alternative protein solutions through the technology they have developed.

Waste Circularity

Despite being a huge issue, emerging technologies can also help tackle food waste in a myriad of ways. Since food waste occurs at every step of the supply chain, from farm to fork, various startups have developed different solutions to target each segment. Some companies are using invisible and edible coatings to improve the shelf-life of fruits and vegetables. Other startups are targeting retailers to help them push products close to their sell-by date instead of dumping expired food. Finally, data systems are helping restaurants, hotel chains, and food outlets track their operations and reduce food waste.

Some of the companies in our portfolio are working to tackle food waste. Orbisk has designed a fully automated food waste monitoring to improve the sustainability and margins of restaurants and food service chains. On the other hand, Delicious Data is a company that has created an AI-based operating system that optimizes operational efficiency for fresh food providers, including bakeries, canteens, and quick-service restaurants.

Novel Ingredients

The goal in this segment is to be able to innovate and introduce functional ingredients to the market. Such innovation is possible thanks to new extraction methods which can ensure high yield and stable production. The Austrian startup, Kern Tec, is one example of a company working on upcycled ingredients. The company is able to convert previously discarded apricot, plum and cherry seeds into a variety of products including protein powders, dairy alternatives, oils and spreads.

Our investment strategy at PeakBridge reflects this, with startups tackling various challenges. Learn more about our full strategy here.

FoodTech as an asset class

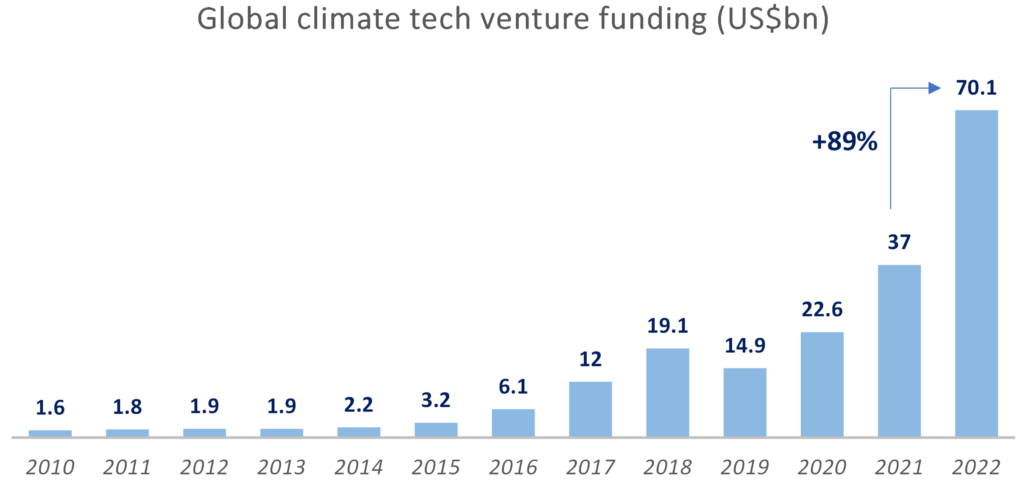

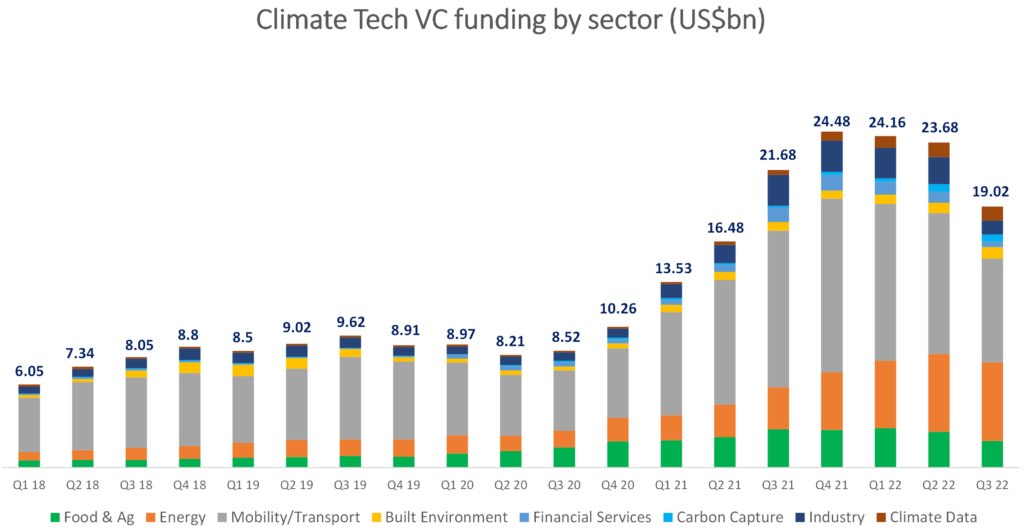

From an investment perspective, food and climate-tech funding is growing rapidly. According to HolonIQ, climate tech in 2022 saw an 89% increase in year-on-year venture capital, with more than $70 billion invested from January to December across 3,330 funding rounds 13 . This is more impressive given that the venture capital market as a whole showed a 42% decline in the first 11 months of 2022 when compared to the same period in 2021.14

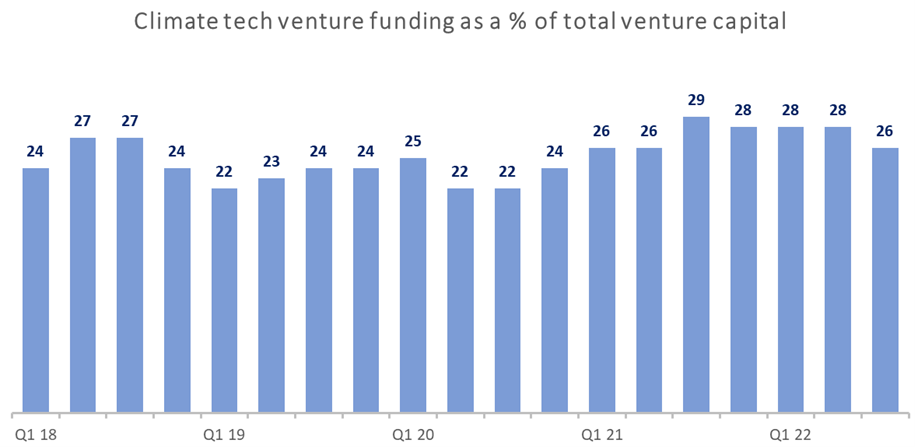

Comparing climate tech venture funding as a percentage of total venture capital, we can observe a trend of 20-30% representation. This trend has been consistent both in greater market activity as well as in market pullbacks.15

Note: 12-month rolling average.

Within climate tech funding, Food & Agriculture is the 3rd largest sector in terms of deal value, behind Energy and Mobility/Transport. Based on deal volume, the Food & Ag segment has attracted the largest number of investors, making it a good place to start for those new to climate investing. Conversely, the Built Environment and Carbon sectors have attracted the fewest investors, possibly because they are considered the most technically complex.16

Note: 12-month rolling average.

When comparing GHG emissions by sector, it is evident that there is an imbalance. Food & Ag which accounts for around 20% of GHG emissions is attracting around 12% of funding. On the other hand, certain sectors such as Mobility/Transport & Industry show a disproportionate amount of funding received in relation to their sector emissions.

Conclusion

The world is currently experiencing a large-scale climate crisis with the food sector being one of the top culprits. Various companies are using novel technologies to help tackle the challenges of our food system from different angles. We think that in the future, the most valuable solutions will be those that are able to scale easily, use minimal resources and energy, and meet the demands of our supply chain both currently and in the future.

Few asset classes and venture capital verticals are immune to volatility, and FoodTech is not exempt. Yet, certain pockets within FoodTech, primarily scalable technologies, remain fundamentally attractive despite the current macro-environment. The ever-growing funding directed towards FoodTech in the last years has been key in establishing the sector. Further FoodTech venture capital investment is needed to ensure the sector continues to grow and scale to be able to reach the audacious climate goals.

Footnotes:

1https://www.un.org/en/global-issues/population

2https://www.bloomberg.com/news/articles/2023-01-13/davos-latest-news-what-will-happen-at-the-world-economic-forum-2023

3https://www.bloomberg.com/news/articles/2022-11-15/battery-storage-tops-list-for-climate-tech-investors-esg-survey

4https://amp-theguardian-com.cdn.ampproject.org/c/s/amp.theguardian.com/environment/2023/jan/05/eu-ban-on-deforestation-

linked-goods-sets-benchmark-say-us-lawmakers

5https://www.researchgate.net/publication/333774310_Wheat_and_barley_markets_in_Vietnam

6https://www.pnas.org/doi/10.1073/pnas.2120584119

7Eutrophication is characterized by excessive plant and algal growth due to the increased availability of one or more limiting growth factors needed for photosynthesis, such as sunlight, carbon dioxide, and nutrient fertilizers.

8https://www.bloomberg.com/graphics/2022-global-diet-homogeneous-food-security-risk/?srnd=premium-europe

9https://drawdown.org/solutions/regenerative-annual-cropping

10 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9024616/

11https://impact.economist.com/sustainability/ecosystems-resources/data-point-the-dirty-truth-about-wasted-food

12 https://food.ec.europa.eu/safety/novel-food_en

13https://www.holoniq.com/notes/2022-climate-tech-vc-funding-totals-70-1b-up-89-from-37-0b-in-2021

14https://www.bloomberg.com/news/articles/2023-01-05/four-key-questions-to-ask-about-climate-investment-in-2023

15https://www.pwc.com/gx/en/services/sustainability/publications/overcoming-inertia-in-climate-tech-investing.html

16https://www.ctvc.co/40b-and-1-000-deals-in-2022-market-downtick/